info

If you want a copy of my budgeting sheet, comment “SHEET” and I’ll send you a link! 📊 Are you in your 30s or 40s and not sure how much money to save into all your accounts? Here’s a quick breakdown of 4 different types of people and their level of budgeting: Level 1: Puts 70% into needs, 30% into wants, and nothing into investing and saving. Level 2: Puts 50% into needs, 30% into wants, 20% into investing and saving. Level 3: Puts 30% into needs, 20% into wants, 50% into investing and saving. Level 4: Puts 10% into needs, 10% into wants, and 80% into investing and saving. Which level budgeter are you? 🙂 -Steve Follow @calltoleap for investing videos! Follow me @calltoleap to learn more things like this about money! @calltoleap @calltoleap @calltoleap Make sure you check out my next beginners investing Master Class on January 7th at 5:30 PM PT the link to sign up is in my bio! 🔥 money investing finance personalfinance budgetingsheet # # # # ##money#investing#finance#personalfinance#budgetingsheetoriginal sound

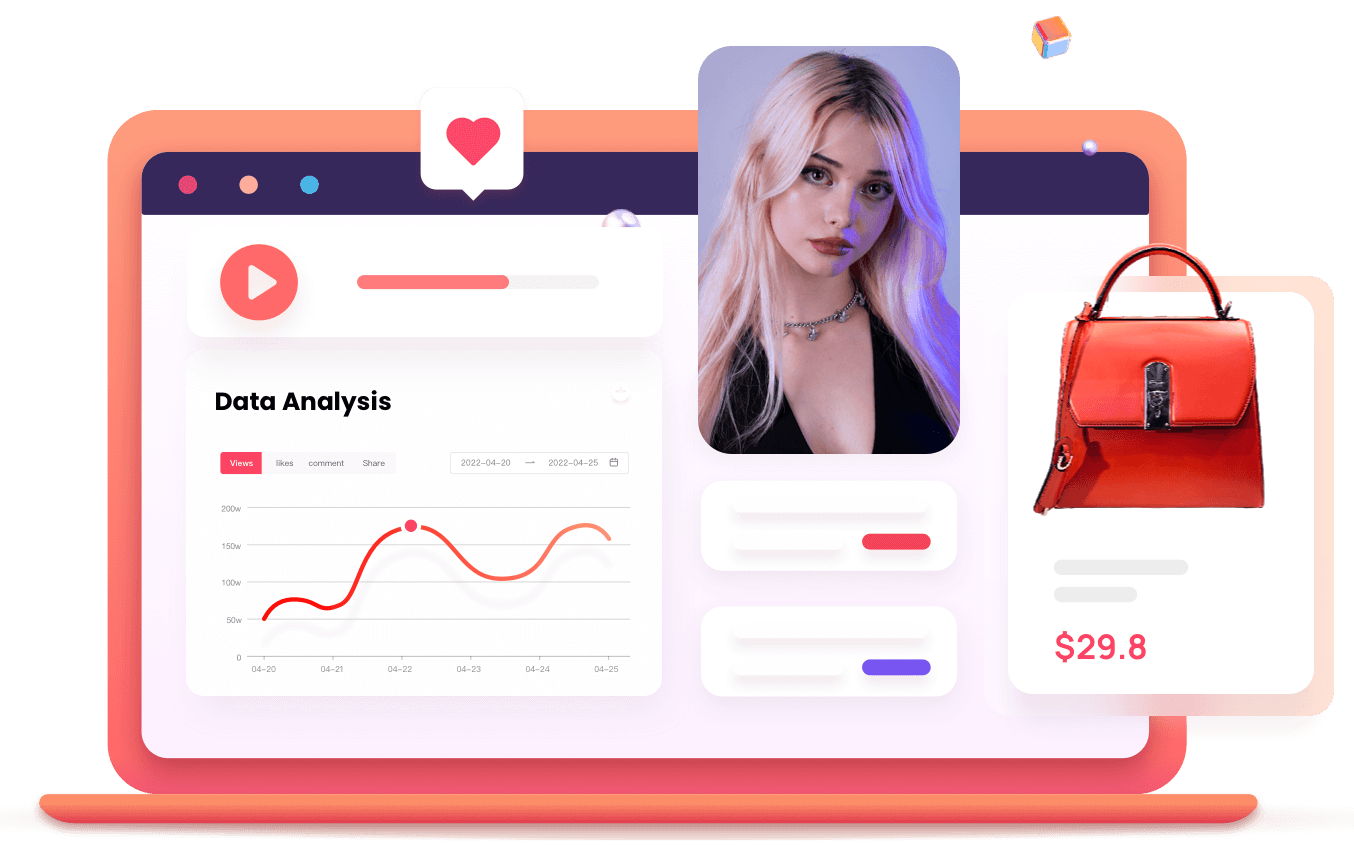

Duration: 58 sPosted : Fri, 13 Dec 2024 00:00:14Views

8.4KDaily-

Likes

221Daily-

Comments

77Daily-

Shares

38Daily-

ER

3.98%Daily-

Latest