info

Commercial Real Estate is like a four letter word in the investing world right now… EVERYONE HATES IT.❌❌❌ THERE’S BLOOD IN THE STREETS. When that’s the sentiment, things get over-cooked, and that may very well be the case in this asset class. The trick is understanding how to get yourself exposure in a risk aware manner. Clearly, buying REITs at a weighted avg cap rate of 6% isn’t as attractive as buying the bonds at 9.36% yield on investment grade bonds. It’s very unusual when bonds have a more significant return profile than stocks in any space- including real estate! Link in bio if you need help creating a sophisticated portfolio. Disclosure: nothing is guaranteed and the investments mentioned can lose money. #stocks#stockmarket#bonds#investing#investor#finance#cfp#cima#economics#commercialrealestate#realestate#lifegoalnation#lifegoalinvestmentsoriginal sound

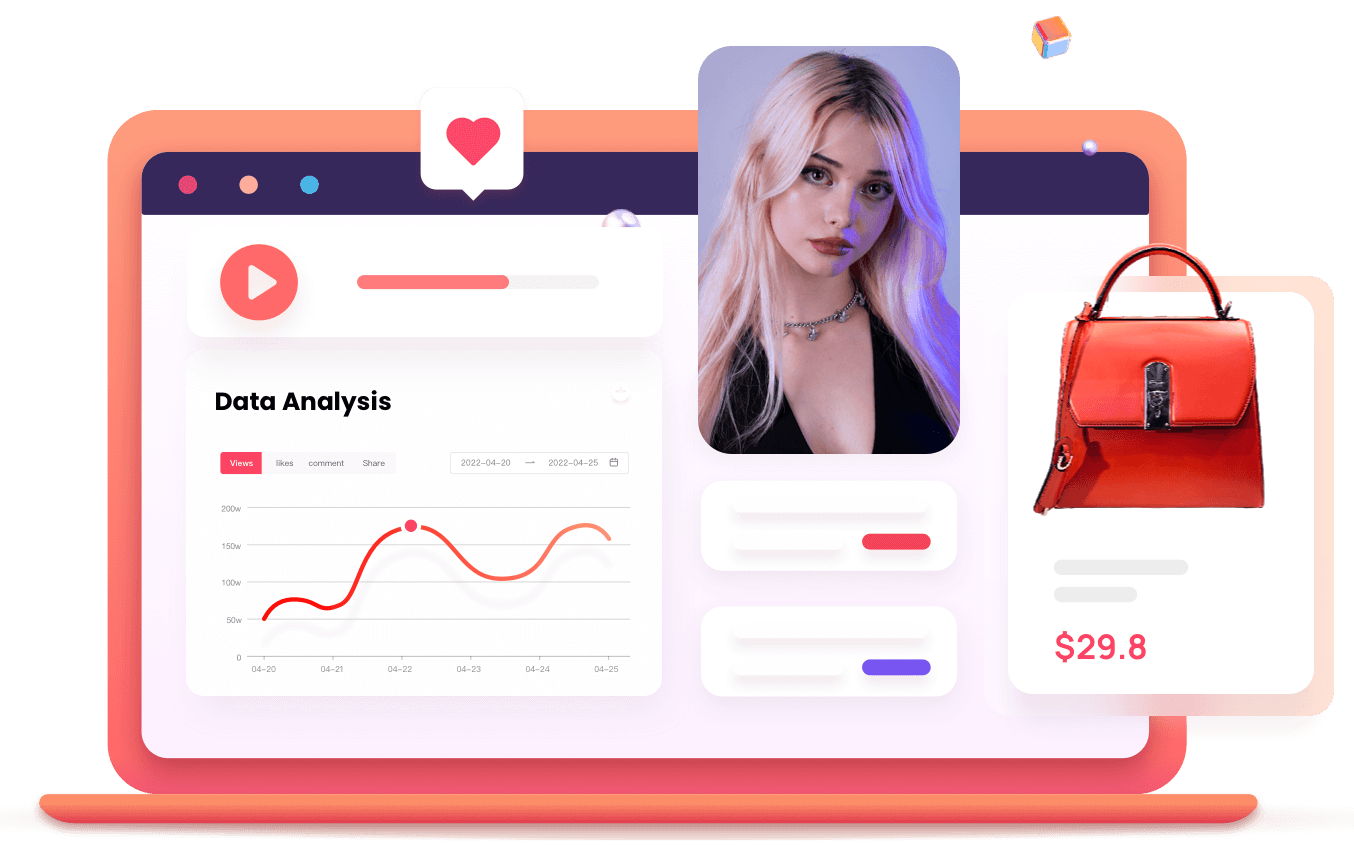

Duration: 114 sPosted : Wed, 07 Feb 2024 16:15:07Views

28.7KDaily-

Likes

1.2KDaily-

Comments

27Daily-

Shares

155Daily-

ER

4.66%Daily-

Latest