info

NANOGrav's data shows how gravity affects spacetime and will help us understand the beginnings of the universe. #nanograv#space#universe#spacetime#science#gravity#davidfriedberg#theallinpod#theoryofrelativity#einstein#nanograv#pulsarInterstellar on Piano

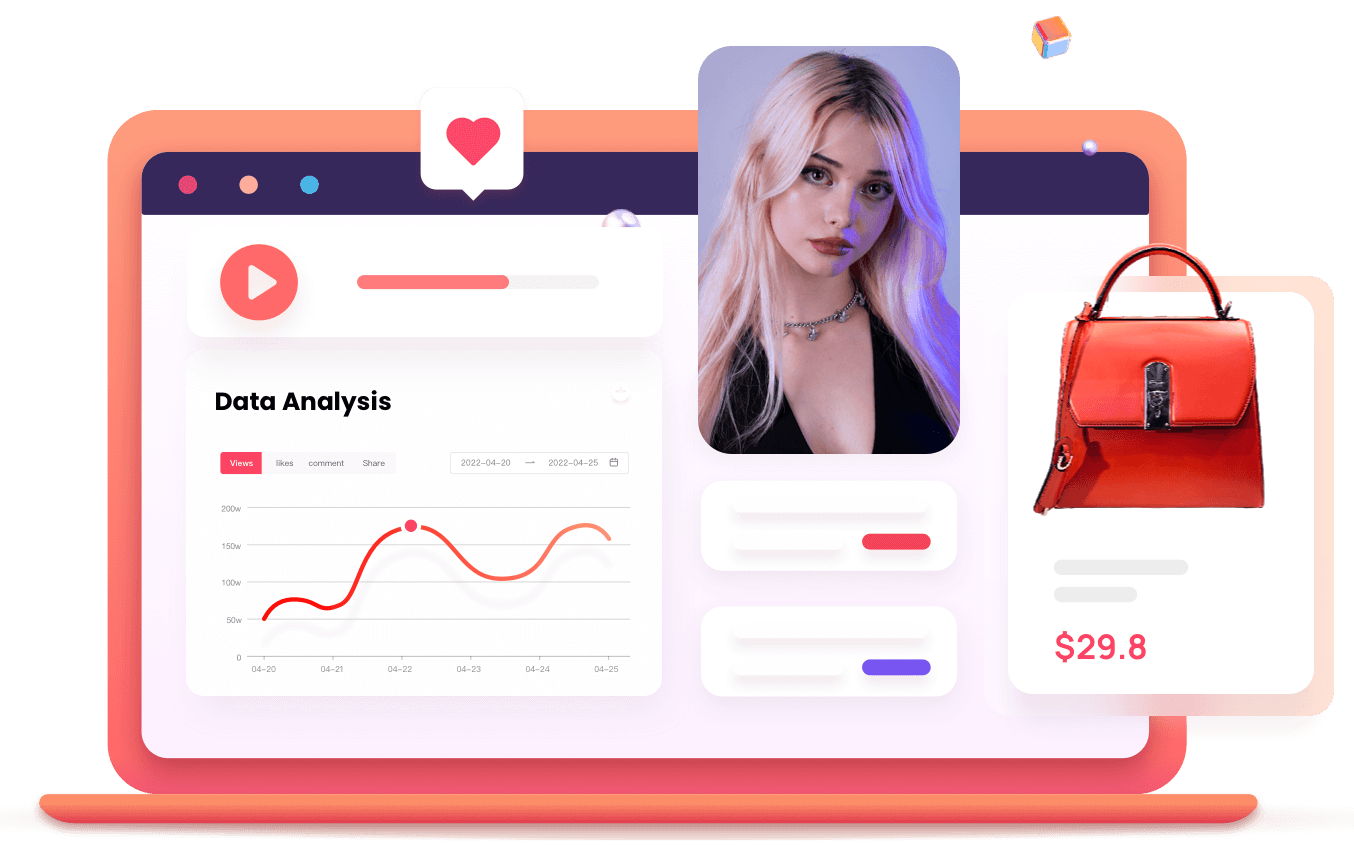

Duration: 153 sPosted : Tue, 11 Jul 2023 00:30:20Views

51.6KDaily-

Likes

1.4KDaily-

Comments

27Daily-

Shares

60Daily-

ER

2.84%Daily-

Latest

🚨 Andrew Schulz and Chamath Discuss the Main Street vs Wall Street Disconnect Schulz: "Every American thinks they're going to be a millionaire. That's what this country drives off of." "And the second they stop thinking they will be, or they can be, it falls apart." "I'm telling you, the you guys of the world need to pay close attention to because there's going to be no empathy if anything bad happens, 'Oh the stock market is down.'" "No Americans are invested in the stock market. That's all you guys." Jason: " Half of the country is." Chamath: " I've been saying it for months. Nobody cares about the stock market. Nor should we." "And the reason is because we, people who own these assets, have overly benefited more than we've deserved for the last 15 years." "We took interest rates literally to zero. Anybody like us who could have gone and gotten levered up and gone into the stock market was richly rewarded." "And the problem is we left everybody else behind." "And I think the great thing about Trump is he is going to reset that he is going to take a lot of wealth away from asset holders. "There is no sympathy. I think it's fantastic." Schulz: " It's great to hear you even saying that, because I feel like a lot of people that are in your guy's position don't understand that disconnect." #stockmarket #politics #economy #comedy #smart #tech #podcast #startups #allin #clips #allinpodcast #learn #mainstreet #wallstreet #business

44.4K

1.8K

109

theallinpod

11 days_ago

Bad News for Stocks and Real Estate: Chamath Explains The Great Economic Reset Chamath points out that Trump has two core constituencies that are generally asset-light: 1) young people 2) working-class / middle-class On E217, he broke down his thoughts: "I tend to be in the Stevie Cohen camp. It's not like the bottom is going to fall out, but there's a lot of room for concern." -- In a recent interview, Steve Cohen said that a combination of tariffs, slowing immigration, and DOGE has him bearish in the short-term. -- "I'm actually pretty negative for the first time in a while. It wouldn't surprise me to see a significant correction." Chamath agreed: "It is bad news for the stock market and it is bad news for asset owners." " I think people want this austerity." " So if you are going to feed your constituents and your constituents don't own stocks and your constituents don't own homes, or they are so wealthy that they can be inoculated from a massive drawdown in those asset categories, what do you think the winning strategy is?" " If you want to cement political power, I think it requires a walking down of these asset markets in a meaningful way." "That's stocks and that's real estate." "And I just don't see any other way around it." #reels #economy #stocks #stockmarket #realestate #home #trump #dc #washington #podcast #startups #tech #politics #allin #clips #allinpodcast

13.4K

290

21

theallinpod

24 days_ago

Stripe's Internal Inflation Indicator: A New and Improved CPI? On E216, Chamath asked Patrick Collison if Stripe had ever considered publishing economic indicators based on their data from $1T+ in annual payment volume. Chamath: " One of the big things that we've talked about is how many backward revisions there are to everything from non-farm payrolls to GDP, that they've become so unreliable." "And so it's very difficult for people that are transacting in market to know what to do." "Have you guys ever thought about that? Because I'm sure that you have a much more accurate sense of where the economy is than many other people." Patrick: "We did look at inflationary data over the last couple of years, and I think you can construct, and the team did construct, a pretty reliable leading indicator for inflation." " And I feel a bit rueful with you asking that question because I feel like on some level we should have done it." "Stripe is not like a full cross-section of the economy." "We're more biased towards online, we're more biased towards innovative companies." "So the interpretation can be a bit tricky." "The second thing is the Stripe business is growing so quickly and changing so fast that again, it's not necessarily representative of the economy." "Having said that, I think in principle, you could draw some conclusions." "And so we would like to share that openly because I think it's a public good for there to be better and more reliable economic data." #inflation #cpi #data #economy #stockmarket #startups #tech #allin #allinpodcast #podcast #clips #learn #founders #entrepreneur #siliconvalley

4.8K

84

4

theallinpod

1 months_ago

Ray Dalio: This market looks a lot like 1998-99 @Ray Dalio joined Friedberg for an All-In interview, where he described the state of the market: On investor psychology: -- "I think a lot of investors make the mistake of thinking, 'I want to buy good things.'" -- "But, a great company that gets expensive is much worse than a bad company that's really cheap." On overpriced companies building AI: -- "Everybody says, 'That's great.' And it's going to be great for the future, like the internet and dot-com, but the price has to be paid attention to." -- "And I'm particularly concerned (for) those companies at a time when we are in a situation with the interest rates operating as we are." Why it feels like 1998-99: -- "In other words, this looks quite a lot like 1998 or '99, where the assets are hot, the prices are high, and you have a rising interest rate environment." -- "That is a classic issue." #stocks #stockmarket #allin #podcast #clips #allinpodcast #investor #investing #ai #bubble #raydalio #wallstreet #smart #learn

8.4K

220

40

theallinpod

1 months_ago