info

How’d I get 107k writeoff out of this 8plex? Purchased for 350k. 70k down. Worth ~500k as is. •Online cost segregation study allowed me to break down the property’s depreciable basis by components. •Components with shorter lifespans were bonus depreciated to accelerate the rate that I can deduct the property’s basis, yielding a net loss that we was able to deduct from all of our businesses other income. 📊Rental Calc & More 👉 Link in Bio 🏘8-hr training program👉Link in Bio 💬DM your deal if you want a video on it! #cashflowtrain#multifamily#businesswomen#cashbuyers#buildwealth#investor#wealthcreators#realestateexpert#commercialrealestate#retirementplanning#realestateinvestors#entrepreneurship#investorhub#wealthylife#businesstips#wealthgenerators#realestateinvestment#financial#retireyoung#realestatetips#businessowner#multifamilyrealestate#realestateexperts#businessowners#financialmanagement#financialmarkets#realestatesalesoriginal sound

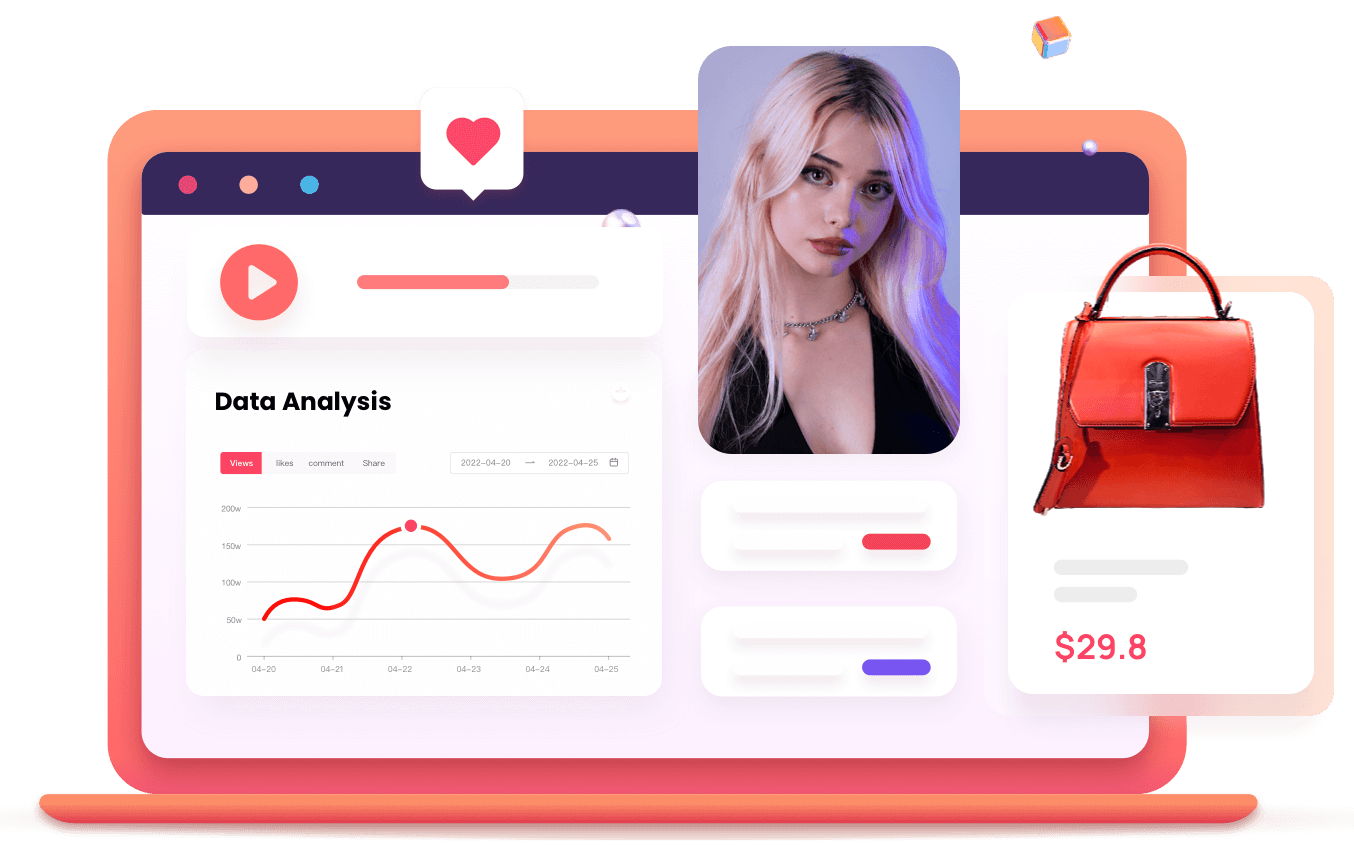

Duration: 26 sPosted : Tue, 07 Feb 2023 16:51:07Views

14.8KDaily-

Likes

454Daily-

Comments

10Daily-

Shares

10Daily-

ER

3.20%Daily-

Latest